Venture capital due diligence: As a venture capitalist, investing in the latest technology is critical to your success. However, evaluating the legitimacy of groundbreaking ideas can be challenging without a Ph.D. and specialized expertise in the field. How can you distinguish between the next SpaceX and another Theranos?

Our Solution: A global team of Ph.D. scientists and engineers dedicated to providing your fund with clear, concise ratings and summaries. With our expertise at your fingertips, you can make informed decisions quickly and confidently, ensuring your investments go towards genuine innovation rather than dead ends or schemes.

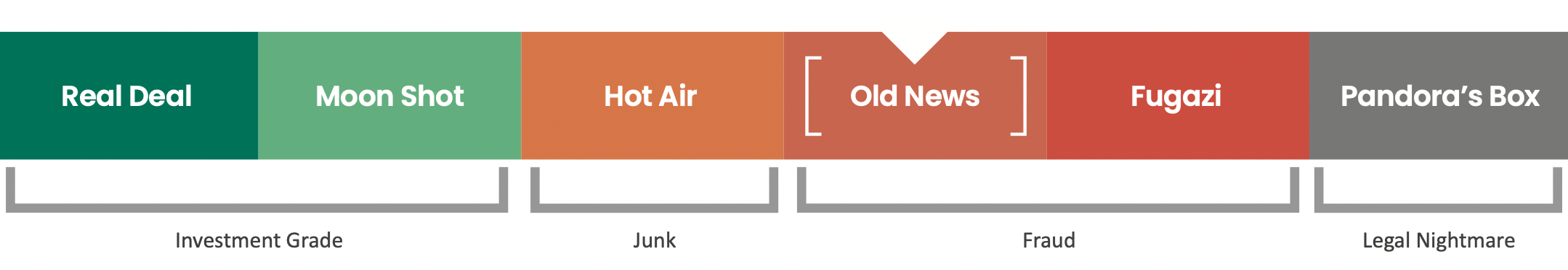

Investing is complex, but our ratings are not.

We assess each company by comparing their claims to published research and established scientific principles. We advise investing only in companies rated as Real Deal or Moonshot, with Hot Air being much higher risk opportunities. By steering clear of Fugazis and focusing on Real Deals and Moonshots, our venture capital diligence services can potentially increase your returns.

Partner with us to unlock the full potential of your investments. Contact us today to learn how our due diligence services can help you make smarter, more informed investment decisions.

Sample Scale: e.g. [Old News] – When old tech is pitched as a breakthrough

*What’s a Fugazi? Well, if you have to ask… Theranos was a fugazi, and there are many more.

Avoid the dreaded “foist”. We’re here to not only shield you from fraud but also to guarantee that you don’t overlook remarkable founders. The truth is, charismatic psychopaths can often outshine others in presentations. That’s why it’s not just about asking the right questions, but rigorously evaluating each claim the CEO makes with scientific precision. Our mission is to foster authentic innovation, as we’re often sought after to help because we don’t just identify flaws; we often provide new solutions for Real Deals or Moonshots. Venture capital due diligence is a fiduciary imperative—no fund is immune to some degree of fraud. We’re here to safeguard your investments and ensure your fund remains free of scientific fraud. Elevate your investment game with [Λ].

Disclaimer: Applied Physics’ Venture Capital Due Diligence service is intended for use by financial professionals and should not be regarded as professional financial investment advice. Applied Physics does not function as a broker/dealer, investment advisor, or any other type of professional consultant. The information contained within our VC due diligence reports should not be construed as legal, tax, accounting, or any other type of consulting service. While Applied Physics guarantees the completeness and accuracy of the information provided, users of our VC due diligence service assume full responsibility for any decisions or actions taken based on the information provided in our reports and agree to indemnify Applied Physics from any claims. Most importantly, by using our services, you acknowledge that you are a financial professional and recognize that we are not consultants; we are Applied Physics.

Applied Physics ® is a public benefit research institute maintained by the scientific community.

[Λ] Applied Physics © 2024